Duke Daytime MBA Student Blog

Asia Business Conference

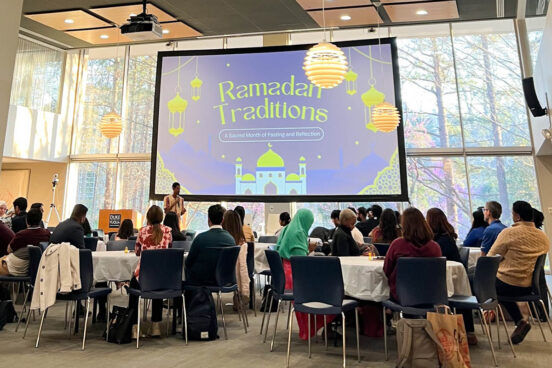

In response to an increasingly global marketplace, typified by multinational corporations and the participation of many diverse actors, Fuqua has continued to fashion itself as an international business school. This has been more than merely a creative marketing slogan. Fuqua’s student body is more than 40% international, and the learning process has taken on a decidedly global flavor. In that spirit, Fuqua held the Asia Business Conference in late February.

The conference was organized by members of Duke MBA Asian Business Club, in partnership with students from the Duke Law School and UNC Kenan-Flagler Business School.

The first guest, Carlyle Group founder David Rubenstein, energetically culled his experiences in finance and in politics to forecast the success of private equity in Asia. He suggested that emerging markets, for the most part, didn’t receive much private equity funding during that vehicle’s early years because, between restrictive governments, massive conglomerates, and family owned businesses, there were few businesses with any likelihood of being sold. However, the tide has turned, he concluded, and the size, fragmented competition, and growth prospects of these economies make investment there very appealing. For students coming from contemporary business schools which stress global thinking and cross-disciplinary thinking, the opportunities are endless, as many of these firms seek not just capital, but insightful and unconventional leadership.

Former GM CEO Rick Wagoner, as well Fuqua Professor Arie Lewin, next discussed GM’s expansion strategy in China. They illustrated a government campaign to improve road conditions and a population enamored with Western engineering as increasing demand, and, though he briefly identified other countries with large growth prospects, the sheer size and growth pattern of China has made it a priority for anyone looking to sell to a burgeoning middle class. He even intimated an unexpected externality; the fledgling Buick line, once thought a vestigial group in America, has gained a renewed presence at home due to its popularity in China. In identifying traits of companies that successfully operate abroad, they suggested that they conventionally get there early, and don’t try to operate from afar – a total commitment is required.

Though there are many well documented drivers of success in business, Mr. Rubinstein and Mr. Wagoner both referenced one not typically heard in discourse about international commerce – failure. Mr. Rubinstein detailed, with the utmost humility, a career in which he served as a policy advisor to Jimmy Carter during a period of 19% inflation, and began a fledgling fund years later with “three guys who knew more than [he] did” only to witness a very unprecedented environment in China when they arrived there.

Mr. Wagoner, similarly, described a lukewarm reception to GM cars upon its initial foray into the growing country, but suggested that years of experience, and a changing geopolitical landscape, have accounted for GM’s prosperity in China during the early part of this century, and, demonstrated that if GM keeps learning from its failures, it’s likely to remain a leader in that market. In a way, this pattern echoed what Dean Blair Sheppard earlier described as an “economic rebalancing” – the world’s economies have begun converging, imperfectly, and no business school can afford to overlook this reality, and everything that it entails.